Search

When FLSA Retaliation Reaches Beyond the Direct Employer

Most people assume FLSA retaliation claims start and end with the employer on the worker’s W-2. Not so. The Ninth Circuit just widened the blast radius. Continue reading

Most people assume FLSA retaliation claims start and end with the employer on the worker’s W-2. Not so. The Ninth Circuit just widened the blast radius. Continue reading

An airline services company once thought a single scheduled break was enough time for a new mom to pump breast milk. The result? A federal lawsuit that is still headed to trial, and a reminder of what today’s PUMP for Nursing Mothers Act now makes crystal clear. Continue reading

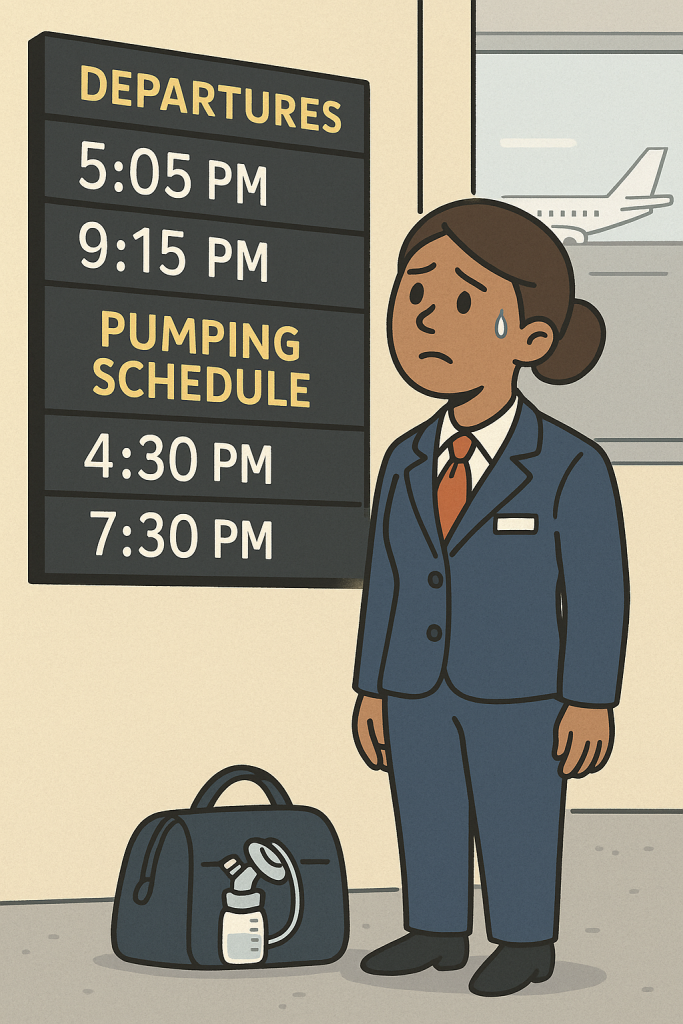

Ever wonder whether two connected businesses, like a restaurant and private club sharing a kitchen and managers, can dodge overtime by claiming they’re separate companies? The U.S. Department of Labor just answered that question loud and clear. Continue reading

If you’ve been clam-oring for clarity on whether front-of-house oyster shuckers can share in the tip pool, the U.S. Department of Labor just served up a pearl of wisdom. Continue reading

When employees rack up overtime without approval, it doesn’t make them look dedicated – it makes them insubordinate. And as one nurse at a VA hospital just learned, that can sink an age discrimination claim.

It’s one of the few government programs that rewards employers for doing the right thing before getting sued. Continue reading

Where have I been? I took a short break from July 4 through July 14 to spend some time offline on vacation with my family. Thanks for your patience—and I promise this one was worth the wait.

The One Big Beautiful Bill (OBBB) became law on July 4—and with it, major new tax and reporting obligations for employers. From payroll compliance to fringe benefit design, much of what’s in this law affects HR, legal, and finance teams directly.

To help employers get ahead of the coming changes, we’re hosting a live Zoom panel discussion (with time for audience Q&A) featuring three top minds in tax and benefits law.

🗓️ Thursday, July 24, 2025 at Noon ET

📍 Zoom: Register here

Continue reading

If the Department of Labor comes knocking about unpaid wages, here’s some welcome news: as of June 27, 2025, it can no longer demand liquidated damages—unless it sues you.

TL;DR: In Field Assistance Bulletin (FAB) 2025-3, the U.S. Department of Labor announced that its Wage and Hour Division (WHD) can no longer seek liquidated damages in administrative investigations under the Fair Labor Standards Act (FLSA). That means employers resolving matters with the DOL—without going to court—are now only liable for back wages.

Paying employees a flat weekly salary doesn’t make them exempt from overtime. One employer just learned that lesson the expensive way—after misclassifying dozens of workers. Continue reading

Paying employees a flat weekly salary doesn’t make them exempt from overtime. One employer just learned that lesson the expensive way—after misclassifying dozens of workers. Continue reading

On Monday, June 2, the U.S. Department of Labor (DOL) announced the relaunch and expansion of its opinion letter program. This move reinstates a valuable compliance tool for employers, particularly those navigating complex wage-and-hour for Family and Medical Leave Act regulations. Continue reading